Presenters: Petter Kolm (NYU, Courant Institute)

Title: Feature Selection in Jump Models

Abstract: Jump models switch infrequently between states to fit a sequence of data while taking the ordering of the data into account. In this talk, we propose a new framework for joint feature selection, parameter and state-sequence estimation in jump models. Feature selection is necessary in high-dimensional settings where the number of features is large compared to the number of observations and the underlying states differ only with respect to a subset of the features. We develop and implement a coordinate descent algorithm that alternates between selecting the features and estimating the model parameters and state sequence, which scales to large data sets with large numbers of (noisy) features. We demonstrate the usefulness of the proposed framework by comparing it with a number of other methods on both simulated and real data in the form of financial returns, protein sequences, and text. The resulting sparse jump model outperforms all other methods considered and is remarkably robust to noise.

This is joint work with Erik Lindstrom and Peter Nystrup.

Category Archives: Events

May 25 at 4 pm (CEST). Laura Ballotta, Fourier-based methods for the management of complex insurance products

Presenters: Laura Ballotta (Cass Business School, City University of London)

Title: Fourier-based methods for the management of complex insurance products

Abstract: This paper proposes a framework for the valuation and the management of complex life insurance contracts, whose design can be described by a portfolio of embedded options, which are activated according to one or more triggering events. These events are in general monitored discretely over the life of the policy, due to the contract terms. Similar designs can also be found in other contexts, such as counterparty credit risk for example. The framework is based on Fourier transform methods as they allow to derive convenient closed analytical formulas for a broad spectrum of underlying dynamics. Multidimensionality issues generated by the discrete monitoring of the triggering events are dealt with efficiently designed Monte Carlo integration strategies. We illustrate the tractability of the proposed approach by means of a detailed study of ratchet variable annuities, which can be considered a prototypical example of these complex structured products. This is joint work with Ernst Eberlein, Thorsten Schmidt and Raghid Zeineddine.

May 18 at 4 pm (CEST). Julien Guyon, Dispersion-Constrained Martingale Schrodinger Problems and the Joint S&P 500/VIX Smile Calibration Puzzle

Presenters: Julien Guyon (Bloomberg, Columbia University, Courant Institute)

Title: Dispersion-Constrained Martingale Schrodinger Problems and the Joint S&P 500/VIX Smile Calibration Puzzle

Abstract: The very high liquidity of S&P 500 (SPX) and VIX derivatives requires that financial institutions price, hedge, and risk-manage their SPX and VIX options portfolios using models that perfectly fit market prices of both SPX and VIX futures and options, jointly. This is known to be a very difficult problem. Since VIX options started trading in 2006, many practitioners and researchers have tried to build such a model. So far the best attempts, which used parametric continuous-time jump-diffusion models on the SPX, could only produce approximate fits. In this talk we solve this long standing puzzle for the first time using a completely different approach: a nonparametric discrete-time model. Given a VIX future maturity T1, we build a joint probability measure on the SPX at T1, the VIX at T1, and the SPX at T2 = T1 + 30 days which is perfectly calibrated to the SPX smiles at T1 and T2, and the VIX future and VIX smile at T1. Our model satisfies the martingality constraint on the SPX as well as the requirement that the VIX at T1 is the implied volatility of the 30-day log-contract on the SPX.

The model is cast as the unique solution of what we call a Dispersion-Constrained Martingale Schrodinger Problem which is solved by duality using an extension of the Sinkhorn algorithm, in the spirit of (De March and Henry-Labordere, Building arbitrage-free implied volatility: Sinkhorn’s algorithm and variants, 2019). We prove that the existence of such a model means that the SPX and VIX markets are jointly arbitrage-free. The algorithm identifies joint SPX/VIX arbitrages should they arise. Our numerical experiments show that the algorithm performs very well in both low and high volatility environments. Finally, we discuss how our technique extends to continuous-time stochastic volatility models, via what we dub VIX-Constrained Martingale Schrodinger Bridges, inspired by the classical Schrodinger bridge of statistical mechanics. The resulting stochastic volatility model is numerically implemented and is shown to achieve joint calibration with very high accuracy.

Time permitting, we will also briefly discuss a few related topics:

(i) a remarkable feature of the SPX and VIX markets: the inversion of convex ordering, and how classical stochastic volatility models can reproduce it;

(ii) why, due to this inversion of convex ordering, and contrary to what has often been stated, among the continuous stochastic volatility models calibrated to the market smile, the local volatility model does not maximize the price of VIX futures.

May 11 at 4 pm (CEST). Loriano Mancini, Portfolio choice when stock returns may disappoint: An empirical analysis based on L-moments

May 11 at 4 pm (CEST).

Presenters: Loriano Mancini (Università della Svizzera Italiana)

Title: Portfolio choice when stock returns may disappoint: An empirical analysis based on L-moments

Abstract: We empirically examine the equity portfolio choices of investors with generalized disappointment aversion (GDA) preferences. The portfolio choice relies on a novel semi-parametric method based on L-moments which permits a large-scale empirical study. GDA investors appear to be very sensitive to higher-order L-moment returns, and to suffer large monetary utility losses from suboptimal portfolio choices such as equally weighted portfolios. These losses increase in the level of disappointment aversion and the number of stocks available for investment.

May 4 at 4 pm (CEST). Lukasz Szpruch, Gradient Flows for Regularized Stochastic Control Problems

May 4 at 4 pm (CEST).

Presenters: Lukasz Szpruch (University of Edinburgh)

Title: Gradient Flows for Regularized Stochastic Control Problems

Abstract: This talk is on stochastic control problems regularized by the relative entropy, where the action space is the space of measures. This setting includes relaxed control problems, problems of finding Markovian controls with the control function replaced by an idealized infinitely wide neural network and can be extended to the search for causal optimal transport maps. By exploiting the Pontryagin optimality principle, we identify suitable metric space on which we construct gradient flow for the measure-valued control process along which the cost functional is guaranteed to decrease. It is shown that under appropriate conditions, this gradient flow has an invariant measure which is the optimal control for the regularized stochastic control problem. If the problem we work with is sufficiently convex, the gradient flow converges exponentially fast. Furthermore, the optimal measured valued control admits Bayesian interpretation which means that one can incorporate prior knowledge when solving stochastic control problems. This work is motivated by a desire to extend the theoretical underpinning for the convergence of stochastic gradient type algorithms widely used in the reinforcement learning community to solve control problems.

Joint work with David Siska (Edinburgh).

April 20 at 4 pm (CEST). Nino Antulov-Fantulin, Complexity and Machine Learning with Financial applications

April 20 at 4 pm (CEST).

Presenters: Nino Antulov-Fantulin (ETH Zurich)

Title: Complexity and Machine Learning with Financial applications

Abstract: Complexity science studies systems and problems that are composed of many components that may interact with each other in a dynamic and non-linear way. In this first part of the talk, the author will motivate and introduce several research questions and directions at the interface of complexity and machine learning: (i) the ability of neural networks to steer or control trajectories of network dynamical systems, (ii) node embedding of directed graphs and (iii) efficient Monte Carlo sampling of epidemic processes. In the second part of the talk, the author will focus on machine learning modelling for (crypto)financial markets.

April 15 at 4 pm (CEST). Blanka Horvath and Issa Zacharia, An Optimal Transport Approach to Market Regime Clustering

April 15 at 4 pm (CEST).

Presenters: Blanka Horvath and Issa Zacharia (King’s College London)

Title: An Optimal Transport Approach to Market Regime Clustering

Abstract: The problem of rapid and automated detection of distinct market regimes is a topic of great interest to financial mathematicians and practitioners alike. In this paper, we outline an unsupervised learning algorithm clusters a given time-series – corresponding to an asset or index – into a suitable number of temporal segments (market regimes). This method – the principle of which is inspired by the well-known k-means algorithm – clusters said segments on the space of probability measures with finite p-th moment. On this space, our choice of metric is the p-Wasserstein distance. We compare our Wasserstein-kmeans approach with a more traditional implementation of the kmeans algorithm by generating clusters in Euclidean space via the first N raw moments of each log-return segment instead (moment-kmeans). We compare the two approaches initially on real data and validate the performance of either algorithm by studying the maximum mean discrepancy between, and within, clusters. We show that the Wasserstein-kmeans algorithm vastly outperforms the moment-based approach on both real and synthetic data. In particular, the Wasserstein-kmeans algorithm performs well, even when the distribution associated to each regime is non-Gaussian.

April 8 at 6 pm (CEST). Andrea Barbon, Brokers and Order Flow Leakage: Evidence from Fire Sales

April 8 at 6 pm (CEST).

Presenters: Andrea Barbon (University of St. Gallen)

Title: Brokers and Order Flow Leakage: Evidence from Fire Sales

Abstract: Using trade‐level data, we study whether brokers play a role in spreading order flow information in the stock market. We focus on large portfolio liquidations that result in temporary price drops, and identify the brokers who intermediate these trades. These brokers’ clients are more likely to predate on the liquidating funds than to provide liquidity. Predation leads to profits of about 25 basis points over 10 days and increases the liquidation costs of the distressed fund by 40%. This evidence suggests a role of information leakage in exacerbating fire sales.

Mehdi Tomas and Michael Benzaquen, Cross-Impact modeling on derivative markets

March 16 at 4 pm (CEST).

Presenters: Mehdi Tomas and Michael Benzaquen (CFM and Ecole Polytechnique)

Title: Cross-Impact modeling on derivative markets

Abstract: Impact modeling on derivatives is challenging on two grounds. First, liquidity in some markets (e.g., options) can be fragmented across correlated, illiquid instruments. Second, their prices are locked by non-arbitrage. Univariate impact models cannot account for these problems. Instead, we need to rely on cross-impact, its cross-sectional generalization. We introduce the Kyle cross-impact model which aggregates liquidity and is consistent with no-arbitrage. We illustrate our framework using data from E-Mini futures, options and VIX futures. The resulting model is useful for optimal execution and estimation of hedging costs.

Michele Vodret and Iacopo Mastromatteo, Understanding the relation between trades and price changes is of paramount importance for practitioners, yet challenging for theoreticians.

March 2 at 5 pm (CEST).

Presenters: Michele Vodret and Iacopo Mastromatteo. (CFM and Ecole Polytechnique)

Title: Understanding the relation between trades and price changes is of paramount importance for practitioners, yet challenging for theoreticians.

Abstract: On one hand models coming from econophysics/quantitative-finance literature predict a price impact function that slowly decays in order to compensate the long-range correlation of the order flow. On the other hand, these models lacks from a proper micro-foundation, customary in models coming from the theoretical economics literature, which build on rational expectations and asymmetric information, and typically prescribe linear impact. Recently, we extended the classic Kyle model, partially bridging the gap between these two classes of models. We will show our findings and suggest future lines of research.

Prof. Matteo Marsili, Relevance

Prof. Matteo Marsili (Abdus Salam ICTP)

Title:

Relevance

Abstract:

The mass is a relevant variable in experiments of free falling bodies, their colour is not. The mass enters the laws that governs how objects fall, their colour does not. How can one identify relevant variables when data is scarce and high dimensional and the laws that govern the phenomena under study are unknown? In order to address this question, I will first argue that relevance can be quantified unambiguously in information theoretic terms, on the basis of a data alone. Samples with maximal relevance, i.e. those which are mostly informative about the generative process, exhibit power law distributions, suggesting a possible origin for the ubiquitous observation of such distributions. In addition, this opens the way to model free approaches to extract relevant information from high dimensional datasets. This will be illustrated in the cases of protein sequences and multi-electrode arrays recording of neural activity.

Aurélien Decelle, Spectral learning of Restricted Boltzmann Machines

Aurélien Decelle (Université Paris-Sud XI)

Title:

Spectral learning of Restricted Boltzmann Machines

Abstract:

In this presentation I will expose our recent results on the Restricted Boltzmann Machine (RBM). The RBM is a generative model very similar to the Ising model, it is composed of both visible and hidden binary variables, and traditionally used in the context of machine learning. In this context, the goal is to inferred the parameters of the RBM such that it reproduces correctly a dataset’s distribution. Although they have been widely used in computer science, the phase diagram of this model is not known precisely in the context of learning. In particular, it is not known how the parameters influence the learning, and what exactly is learned within the parameters of the model. In our work, we show how the SVD of the data governs the first phase of the learning and how this decomposition helps to dynamics and the equilibrium properties of the model.

Jacopo Rocchi, Self-sustained clusters in spin glass models

Jacopo Rocchi (LPTMS, Université Paris-Sud)

Title:

Self-sustained clusters in spin glass models

Abstract:

While macroscopic properties of spin glasses have been thoroughly investigated, their manifestation in the corresponding microscopic configurations is much less understood. To identify the emerging microscopic structures with macroscopic phases at different temperatures, we introduce the concept of self-sustained clusters (SSC). SSC are regions of the space where in-cluster induced fields dominate over the field induced by out-cluster spins. We study their properties in the Ising p-spin model with p=3 using replicas. The intuition gained using fully connected models is then used in the study of models defined on random graphs. A message-passing algorithm is developed to determine the probability of individual spins to belong to SSC. Results for specific instances, which compare the predicted SSC associations with the dynamical properties of the spins, are obtained from numerical simulations. This insight gives rise to a way to predict individual spin dynamics from a single snapshot of spin configurations.

Prof. Jean Jacod, Modeling asset prices: small scale versus large scale

Jean Jacod (Université Paris 6, Pierre et Marie Curie)

Title:

Modeling asset prices: small scale versus large scale

Abstract:

A typical model for the price of financial asset, allowing for explicit or numerical computation of option prices, hedging, calibration, etc… , describes the price with an horizon of months or years. In contrast, a very active topic now is concerned with models for tick prices or order books. The structure of the price at the microscopic level is very di_erent from the structure of the usual (often continuous) semimartingales used at a macroscopic level. In particular the microscopic prices evolves on the tick grid, usually going up or down by one tick only. Our aim is to see how it is possible to reconcile the two viewpoints, using a scaling limit of tick-level price models. We will see that this question (going back to the thesis of Bachelier, in a sense) raises a number of non trivial questions if we want a reasonably simple microscopic model, together with a macroscopic model exhibiting stochastic volatility or jumps or a drift.

(Joint work with Yacine Ait-Sahalia).

Hye-Jin Cho, On Overconfidence, Bubbles and the Stochastic Discount Factor

Wednesday, 09/05/2018

14:00

Scuola Normale Superiore

Aula Bianchi Scienze

Hye-Jin Cho

University of Paris 1 – Panthéon Sorbonne

Abstract

This study is intended to provide a continuous-time equilibrium model

in which overconfidence generates disagreements among two groups

regarding asset fundamentals. Every agent in trading wants to sell

more than the average stock price in the market. However, the

overconfident agent drives a speculative bubble with a false belief

that the stock price will tend to move to the average price over time.

I represent the difference between a false belief and a stochastic

stationary process which does not change when shifted in time. The gap

of beliefs shows how to accommodate dynamic fluctuations as parameters

change such as the degree of overconfidence or the information of

signals. By showing how changes in an expectation operator affect the

stochastic variance of economic fundamentals, speculative bubbles are

revealed at the burst independently from the market.

Tomasz Gubiec , Continuous Time Random Walk in finance. The story of symbiosis.

Wednesday, 02/05/2018

14:00

Scuola Normale Superiore

Aula Marie Curie

Tomasz Gubiec

University of Warsaw

Abstract

Over 50 years ago, two physicists Montroll and Weiss in the physical context of dispersive transport and diffusion introduced stochastic process, named Continuous-Time Random Walk (CTRW). The trajectory of such a process is created by elementary events ‘spatial’ jumps of the stochastic process preceded by waiting (or interevent or pausing) time. Since introduction, CTRW found innumerable application in different fields [1]. In this seminar, I will focus on the application of CTRW to finance [2] and I will tell the story of how this application turned out to be fruitful for both sided and motivated new directions of research [3,4].

[1] Kutner, R., & Masoliver, J. (2017). The continuous time random walk, still trendy: fifty-year history, state of art and outlook. The European Physical Journal B, 90(3), 50

[2] Scalas, E. (2006). Five years of continuous-time random walks in econophysics. In The complex networks of economic interactions (pp. 3-16). Springer, Berlin, Heidelberg.

[3] Gubiec, T., & Kutner, R. (2010). Backward jump continuous-time random walk: An application to market trading. Physical Review E, 82(4), 046119

[4] Gubiec, T., & Kutner, R. (2017). Continuous-Time Random Walk with multi-step memory: an application to market dynamics. The European Physical Journal B, 90(11), 228

Frontiers in High-Frequency Financial Econometrics 2018

Elisa Alos, The implied volatility surface in modeling problems

Tuesday 27-03-2018

11:00

Scuola Normale Superiore

Aula Fermi

Elisa Alos

Universitat Pompeu Fabra, Barcellona

Abstract

In the Black-Scholes model, the volatility parameter is constant. But it is well-known that, if we compute this volatility parameter by inverting market option prices, the result (the implied volatility) will depend on the strike price (a variation described graphically as a smile or skew) and on time to maturity. Classical stochastic volatility models, where the volatility is allowed to be a diffusion process, can capture the observed smiles and skews, but they cannot easily explain the term structure. For instance, recent numerical analysis state that the skew slope is approximately $O((T )^{-k})$, for some positive $k$ and where $T$ denotes the time to maturity, while the rate for these stochastic volatility models is $O(1)$. In this talk, we will see how to construct new stochastic volatility models that can describe this phenomena. Towards this end, we will present short-time approximations for the implied volatility skew and smile. The obtained formulas will give us a useful tool to identify the volatilities that can explain this term structure. Based on this approach, some new models have been proposed recently (as, for example, rough volatilities). In this talk we will discuss on the state of the art of this modeling research, and we will discuss the main advantages and disavantages of these new models.

Luciano Campi. Nonzero-sum stochastic differential games with impulse controls: a verification theorem with applications

Speaker:

Prof. Luciano Campi (London School of Economics)

Title:

Nonzero-sum stochastic differential games with impulse controls: a verification theorem with applications

Abstract:

We consider a general nonzero-sum impulse game with two players. The main mathematical contribution of the paper is a verification theorem which provides, under some regularity conditions, a suitable system of quasi-variational inequalities for the value functions and the optimal strategies of the two players. As an application, we study an impulse game with a one-dimensional state variable, following a real-valued scaled Brownian motion, and two players with linear and symmetric running payoffs. We fully characterize a Nash equilibrium and provide explicit expressions for the optimal strategies and the value functions. We also prove some asymptotic results with respect to the intervention costs. Finally, we consider two further non-symmetric examples where a Nash equilibrium is found numerically.

Topics in portfolio choice III – Prof. Paolo Guasoni

Topics in portfolio choice II – Prof. Paolo Guasoni

Topics in portfolio choice I – Prof. Paolo Guasoni

Paolo Guasoni, “Stochastics and market frictions: An overview”

Wednesday October 19 2016

15:00

Scuola Normale Superiore

Aula Mancini

Paolo Guasoni

Dublin City University

Abstract

In the last decades Finance theory has benefited from its affinity with the theory of Stochastic Processes, in particular martingales and stochastic control. These theories have subtly influenced the development of Finance along the path in which they were most successful, thereby disregarding market frictions such as trading costs, incomplete information, and incentives. This talk outlines recent developments in stochastic methods for models with frictions, how they undermine several tenets of portfolio theory, and how they stimulate new approaches to stochastic control. The talk concludes with a mention of frictions arising from mortality and operational risk.

Franco Flandoli, “From Clinical Oncology to scaling limits”

Thursday October 13 2016

16:30

Scuola Normale Superiore

Aula Bianchi

Franco Flandoli

University of Pisa

Abstract

A problem of Clinical Oncology will be shortly introduced and its modelling based on differential equations and statistical elements will be illustrated. The above modelling is the simplest possible, for a first investigation. In order to make it more realistic, two natural mathematical elements are particle systems and Partial Differential Equations. It is here that scaling limit questions arise. As an example, two problems will be described: a first, partially solved one, connecting proliferating particles with the so called Fisher-KPP equations; and a second one, widely open, about the features, potentially of KPZ type, of the proliferating boundary.

Damiano Brigo, “Intrinsic stochastic differential equations as jets: theory and applications”

Monday October 10 2016

16:00

Scuola Normale Superiore

Aula Mancini

Damiano Brigo

Imperial College, London

Abstract

We quickly introduce Stochastic Differential Equations (SDEs) and their two main calculi: Ito and Stratonovich. Briefly recalling the definition of jets, we show how Ito SDEs on manifolds may be defined intuitively as 2-jets of curves driven by Brownian motion and show how this relationship can be interpreted in terms of a convergent numerical scheme. We show how jets can lead to intuitive and intrinsic representations of Ito SDEs, presenting several plots and numerical examples. We give a new geometric interpretation of the Ito-Stratonovich transformation in terms of the 2-jets of curves induced by consecutive vector flows. We interpret classic quantities and operators in stochastic analysis geometrically. We hint at applications of the jet representation to i) dimensionality reduction by projection of infinite dimensional stochastic partial differential equations (SPDEs) onto finite dimensional submanifolds for the filtering problem in signal processing, and ii) consistency between dynamics of interest rate factors and parametric form of term structures in mathematical finance. We explain that the mainstream choice of Stratonovich calculus for stochastic differential geometry is not optimal when combining geometry and probability, using the mean square optimality of projection on submanifolds as a fundamental

application.

Gabriele La Spada, “Competition, reach for yield, and money market funds”

Tuesday September 13 2016

11:00

Scuola Normale Superiore

Aula Bianchi

Gabriele La Spada

Federal Reserve Bank of New York

Abstract

Do asset managers reach for yield because of competitive pressures in a low-rate environment? I propose a tournament model of money market funds (MMFs) to study this issue. When funds care about relative performance, an increase in the risk premium leads funds with lower default costs to increase risk-taking, while funds with higher default costs decrease risk-taking. Without changes in the premium, lower risk-free rates reduce the risk-taking of all funds. I show that these predictions are consistent with MMF risk-taking during the 2002-08 period and that rank-based performance is indeed a key determinant of money flows to MMFs.

Anirban Chakraborti, “Sectoral co-movements and volatilities of Indian stock market: An analysis of daily returns data”

Wednesday July 6 2016

11:30

Scuola Normale Superiore

Aula Fermi

Anirban Chakraborti

Jawaharlal Nehru University, New Delhi, India

Abstract

First, we review the techniques of decomposing aggregate correlation matrices to study co-movements in financial data. We apply the techniques to daily return time series from the Indian stock market. Secondly, we use the multi-dimensional scaling methods to visualise the dynamic evolution of the stock market. This method helps to differentiate sectors in the market in the form of clusters. The other objective is to detect periods of instability in the market. Finally, our aim is to decompose the aggregate volatility into sectoral components. Such a mapping allows us to study impact of different sectors on the market behaviour and vice versa.

Marc Mezard, “Boole, Shannon, and the challenge of data science: A statistical physics perspective”

Wednesday June 29 2016

15:00

Scuola Normale Superiore

Aula Azzurra

Marc Mezard

École Normale Supérieure, Paris

Abstract

In 1854, in his treatise on the Laws of Nature, George Boole had stated a clear goal : « to investigate the fundamental laws of those operations of the mind by which reasoning is performed ». This led him to study the foundations of logic and of probabilities. A century later, Claude Shannon opened the way to a mathematical understanding of information and of its communication. The fields of research initiated by these two giants play a major role in contemporary science, and in particular in the handling of large amounts of data, and in the extraction of information out of these data. However, in large-size problems, collective phenomena of the type studied in statistical physics, like phase transitions, start to play a major role. This talk will study the importance of phase transitions in some core problems of Boolean logics and of information theory, with a special focus on the importance of glassy phases.

Jiro Akahori, “Ito atlas and around”

Thursday March 17 2016

13:00

Scuola Normale Superiore

Aula Mancini

Jiro Akahori

Ritsumeikan University, Shiga, Japan

Abstract

I will discuss Malliavin’s canonic diffusion on the circle and related topics including a link to the Fourier method.

Christian Brownlees, “Community Detection in Partial Correlation Networks”

Friday March 11 2016

10:30

Scuola Normale Superiore

Aula Bianchi

Christian Brownlees

Universitat Pompeu Fabra, Barcelona

Abstract

In this work we propose a community detection algorithm for partial correlation networks. We assume that the variables in the network are partitioned into communities. The presence of nonzero partial correlation between two variables is determined by a Bernoulli trial whose probability depends on whether the variables belong to the same community or not. The community partition is assumed to be unobserved and the goal is to recover it from a sample of observations. To tackle this problem we introduce a community detection algorithm called Blockbuster. The algorithm detects communities by applying k-means clustering to the eigenvectors corresponding to the largest eigenvalues of the sample covariance matrix. We study the properties of the procedure and show that Blockbuster consistently detects communities when the network dimension and the sample size are large. The methodology is used to study real activity clustering in the United States.

Maria Rita Iacò, “Copulas in uniform distribution, optimal transport and finance”

Tuesday January 26 2016

13:00

Scuola Normale Superiore

Aula Bianchi

Maria Rita Iacò

Technische Universität Graz

Abstract

The aim of this talk is to give an overview of some results obtained in the framework of copulas. The last ones got considerable attention in the last years, especially in finance where they are used to perform stress-tests and robustness checks in situations of extreme downside events. However, soon after the global financial crisis of 2007–2008, several people argued that copulas, together with other mathematical instruments, have been one of the main causes of the market crashes.

During this talk I will describe some problems in uniform distribution and finance which were described by using a copula approach. Since we will deal with an optimisation problem, we will finally show how this problem can be perfectly embedded in the general theory of optimal transport.

Nicola Fusari, “Pricing Short-Term Market Risk: Evidence from Weekly Options”

Thursday December 17 2015

13:00

Scuola Normale Superiore

Aula Bianchi

Nicola Fusari

Johns Hopkins Carey Business School

Abstract

We study short-term market risks implied by weekly S&P 500 index options. The introduction of weekly options has dramatically shifted the maturity profile of traded options over the last five years, with a substantial proportion now having expiry within one week. Economically, this reflects a desire among investors for actively managing their exposure to very short-term risks. Such short-dated options provide an easy and direct way to study market volatility and jump risks. Unlike longer-dated options, they are largely insensitive to the risk of intertemporal shifts in the economic environment, i.e., changes in the investment opportunity set. Adopting a novel general semi-nonparametric approach, we uncover variation in the shape of the negative market jump tail risk which is not spanned by market volatility. Incidents of such tail shape shifts co- incide with serious mispricing of standard parametric models for longer-dated options. As such, our approach allows for easy identification of periods of heightened concerns about negative tail events on the market that are not always “signaled” by the level of market volatility and elude standard asset pricing models.

Joint work with Torben G. Andersen AND Viktor Todorov.

Domenico Di Gangi, “Assessing Systemic Risk Due to Fire Sales Spillover Through Maximum Entropy Network Reconstruction”

Wednesday November 11 2015

13:00

Scuola Normale Superiore

Aula Bianchi

Domenico Di Gangi

Department of Physics, University of Pisa,

Abstract

Assessing systemic risk in financial markets is of great importance but it often requires data that are unavailable or available at a very low frequency. For this reason, systemic risk assessment with partial information is potentially very useful for regulators and other stakeholders. In this paper we consider systemic risk due to fire sales spillover and portfolio rebalancing by using the risk metrics defined by Greenwood et al. (2015). By using the Maximum Entropy principle we propose a method to assess aggregated and single bank’s systemicness and vulnerability and to statistically test for a change in these variables when only the information on the size of each bank and the capitalization of the investment assets are available. We prove the effectiveness of our method on 2001-2013 quarterly data of US banks for which portfolio composition is available.

Please find the preprint at the url:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2639178

Frederic Abergel, “Limit order books driven by Hawkes processes”

Tuesday September 8 2015

11:30

Scuola Normale Superiore

Aula Bianchi

Frederic Abergel

CMAP, Ecole Centrale-Supelec, Paris

Abstract

Hawkes processes offer an interesting toolbox to model the interplay between different agents on financial markets. This talk will present some recent results on Hawkes process-driven limit order books, focusing on questions of ergodicity and asymptotic behaviour. Some numerical simulations will also be commented.

Roberto Casarin, “Bayesian Nonparametric Calibration and Combination of Predictive Distributions”

Thursday July 2 2015

13:00

Scuola Normale Superiore

Aula Bianchi

Roberto Casarin

Department of Economics – Università Ca’ Foscari di Venezia

Abstract

We introduce a Bayesian approach to predictive density calibration and combination that accounts for parameter uncertainty and model set incompleteness through the use of random calibration functionals and random combination weights. Building on the work of Ranjan and Gneiting (2010) and Gneiting and Ranjan (2013), we use infinite beta mixtures for the calibration. The proposed Bayesian nonparametric approach takes advantage of the flexibility of Dirichlet process mixtures to achieve any continuous deformation of linearly combined predictive distributions. The inference procedure is based on Gibbs sampling and allows accounting for uncertainty in the number of mixture components, mixture weights, and calibration parameters. The weak posterior consistency of the Bayesian nonparametric calibration is provided under suitable conditions for unknown true density. We study the methodology in simulation examples with fat tails and multimodal densities and apply it to density forecasts of daily S&P returns and daily maximum wind speed at the Frankfurt airport. Joint work with Federico Bassetti and Francesco Ravazzolo.

XVII Workshop on Quantitative Finance

The quantitative finance group of the Scuola Normale Superiore will host the XVII Workshop on Quantitative Finance.

The workshop will take place on January, 28-29, 2016 in Pisa at Scuola Normale Superiore.

Andrea Pallavicini, “Arbitrage-Free Pricing with Funding Costs and Collateralization”

Friday May 29 2015

9.30 – 13.00

Scuola Normale Superiore

Aula Fermi

Andrea Pallavicini

Banca IMI, Milano and Imperial College, London

Arbitrage-Free Pricing with Funding Costs and Collateralization

Abstract

The financial crisis started in 2007 has shown that any pricing framework must include from the very beginning the possibility of default of any market player. As a consequence derivative valuation and risk analysis have moved from exotic derivatives managed on simple single-asset classes to simple derivatives embedding credit risk and new, or previously neglected, types of complex and interconnected non-linear effects. Derivative valuation is adjusted to include counterparty credit risk and contagion effects along with funding costs due to collateral posting, treasury policies, and regulatory constraints. A second level of complexity is produced by moving from a single trade to the whole bank portfolio. Aggregation-dependent valuation processes, and theirs operational challenges, arising from non-linearities are discussed both from a mathematical and practical point of view.

Download slides here.

All interested people are kindly invited.

Massimiliano Caporin, “The impact of network connectivity on factor exposures, asset pricing and portfolio diversification”

Wednesday May 6 2015

13:00

Scuola Normale Superiore

Aula Bianchi

Massimiliano Caporin

Department of Economics and Management “Marco Fanno” – Università di Padova

Abstract

The need for understanding the propagation mechanisms behind the recent financial crises lead the increased interest for works associated with asset interconnections. In this framework, network-based methods have been used to infer from data the linkages between institutions. In this paper, we elaborate on this and make a step forward by introducing network linkages into linear factor models. Networks are used to infer the exogenous and contemporaneous links across assets, and impacts on several dimensions: network exposures act as in inflating factor for systematic exposure to common factors with implications for pricing; the power of diversication is reduced by the presence of network connections; in the presence of network links a misspecied traditional linear factor model provides residuals that are correlated and heteroskedastic. We support our claims with an extensive simulation experiment. Joint work with Monica Billio, Roberto Panzica, and Loriana Pelizzon.

Andrea Sillari, “Risk Models – Operation, Maintenance, Upgrade”

Thursday April 21 2015

13:00

Scuola Normale Superiore

Aula Mancini

Andrea Sillari

Unicredit Bank – Milano

Vladimir Filimonov, “Exogenous versus endogenous dynamics in the price discovery process”

Thursday April 14 2015

13.00

Scuola Normale Superiore

Aula Russo

Vladimir Filimonov

ETH Zurich, Switzerland

Abstract

The talk discusses feedback mechanisms in the price discovery process: from high-frequency market-making and algorithmic trading to long-term behavioral mechanisms. In order to quantify short-term endogeneity we propose an index derived by calibrating the self-excited Hawkes model on empirical time series of trades. The Hawkes model accounts simultaneously for the co-existence and interplay between the exogenous impact and the the feedback look by which past trading activity may influence future trading activity. Technically known in the mathematical literature on branching processes as the branching ratio, the reflexivity index is defined as an average ratio of the number of price moves that are due to endogenous interactions to the total number of all price changes, which also include exogenous events. This index quantifies at the same time both “criticality” of the system (stability and susceptibility to large shocks) and its “efficiency” (in sense of the Efficient Market Hypothesis). We calibrate our measure on several financial and commodity futures markets and documented presence of “micro” regime shifts that coincided with “macro” changes in trading methods or sentiments of investors. Finally we relate our analysis to recent evidences of an intrinsic “criticality” of price discovery and make a bridge between short- and long-memory models.

Joao da Gama Batista, “Sudden trust collapse in networked societies”

Friday April 10 2015

13.00

Scuola Normale Superiore

Aula Bianchi

Joao da Gama Batista

Laboratoire de mathématiques appliquées aux systèmes – École Centrale de Paris

Abstract

Trust is a collective, self-fulfilling phenomenon that suggests analogies with phase transitions. We introduce a stylized model for the build-up and collapse of trust in networks, which generically displays a first order transition. The basic assumption of our model is that whereas trustworthiness begets trustworthiness, panic also begets panic, in the sense that a small decrease in trustworthiness may be amplified and ultimately lead to a sudden and catastrophic drop of collective trust. We show, using both numerical simulations and mean-field analytic arguments, that there are extended regions of the parameter space where two equilibrium states coexist: a well-connected network where global confidence is high, and a poorly connected network where global confidence is low. In these coexistence regions, spontaneous jumps from the well-connected state to the poorly connected state can occur, corresponding to a sudden collapse of trust that is not caused by any major external catastrophe. In large systems, spontaneous crises are replaced by history dependence: whether the system is found in one state or in the other essentially depends on initial conditions.

Tommaso Colozza, “Supply of public debt and demand for risk premia: a Minskian approach to credit risk”

Wednesday April 1 2015

13.00

Scuola Normale Superiore

Aula Mancini

Tommaso Colozza

Dipartimento di Statistica e Matematica Applicata all’Economia – Università di Pisa

Abstract

Financial stability of EMU countries is managed by policy makers through several key macroeconomic indicators; the market instead monitors creditworthiness with credit risk premia embedded in sovereign yields. A demand-supply approach solves this duality: in a Minskian framework, positive inelastic shifts in debt-to-GDP ratio due to widespread macro-financial distress may lower risk appetites of lenders and increase risk premia, up to default. Time-variating risk appetites justify statistical relevance of debt-to-gdp variation on yields levels; if conveniently decomposed, debt velocity allows also to imply a default probability measure comparable to standard CDS-implied measures.

Roberto Renò, “Multi-jumps”

Friday March 20 2015

13.00

Scuola Normale Superiore

Aula Bianchi

Roberto Renò

Dipartimento di Economia Politica e Statistica – Università di Siena

Abstract

The simultaneous occurrence of jumps in several stocks (multi-jumps) can be associated to major nancial news, is correlated with sudden spikes of the variance risk premium, and determines an increase in the stock variances and correlations which signicantly deteriorates the diversication potential of asset allocation. The latter evidence implies a reduction in the demand of stocks by an aware risk-averse investor. These facts can be easily overlooked by the usage of standard univariate jump statistics, which just lack sucient power. They are instead revealed in a clearly cut way by using a novel test based on smoothed estimators of the integrated variance ofindividual stocks.

Joint work with Massimiliano Caporin and Aleksey Kolokolov.

Roberto Baviera, “A thermometer for financial instability in the euro area economy and the role of carry trade”

Thursday February 19 2015

13.00

Scuola Normale Superiore

Aula Bianchi

Roberto Baviera

Financial Engineering, Dipartimento di Matematica -Politecnico di Milano

Abstract

This study suggests a simple financial instability indicator for the euro area economy.

It works as a discrete thermometer with three possible outcomes depending on the severity of the crisis. This indicator is based on the specific shape of the credit term structure for the two main peripheral countries in the area. The paper discusses how some key features of term structure are linked to government debt carry trade.

In order to assess the performance of the proposed market-based indicator, the paper shows how the identified episodes of financial turmoil are related with the timing and the intensity of unconventional measures in the euro area.

Fabio Caccioli, “Instabilities in portfolio optimization and regularization”

Tuesday November 4 2014

13.00

Scuola Normale Superiore

Aula Bianchi

Fabio Caccioli

University College London

Abstract

We consider the problem of portfolio selection in presence of market impact, and we show that including a term which accounts for finite liquidity in portfolio optimization naturally mitigates the instabilities that arise in the estimation of coherent risk measures. This is because taking into account the impact of trading in the market is mathematically equivalent to introducing a regularization on the risk measure. We show that the impact function determines which regularizer is to be used, and we characterize the typical behavior of the optimal portfolio in the limit of large portfolio sizes for the case of Expected Shortfall.

Xuezhong He, “Optimality of momentum and reversal”

Wednesday September 10 2014

13.00

Scuola Normale Superiore

Aula Bianchi

Xuezhong He

University of Technology – Sydney (Australia)

Abstract

We develop a continuous-time asset price model to capture short-run momentum and long-run reversal. By studying a dynamic asset allocation problem, we derive the optimal investment strategy in closed form and show that the combined momentum and reversal strategies are optimal. We then estimate the model to the S&P 500 and demonstrate that, by taking the timing opportunity with respect to trend in return and market volatility, the optimal strategies outperform not only pure momentum and pure mean reversion strategies, but also the market index and time series momentum strategy. Furthermore we show that the optimality also holds to the out-of-sample tests and short-sale constraints and the out performance is immune to market states, investor sentiment and market volatility.

Luca Capriotti, “Real Time Risk Management with Adjoint Algorithmic Differentiaton”

Friday June 20 2014

11.00 – 12.30, 14.30 – 16.00

Scuola Normale Superiore

Aula Bianchi

Luca Capriotti

Credit Suisse London

Real Time Risk Management with Adjoint Algorithmic Differentiaton

Abstract

Adjoint Algorithmic Differentiation (AAD) is one of the principal innovations in risk management of the recent times. In this minicourse I will introduce AAD and show how it can be used to implement the calculation of price sensitivities in complete generality and with minimal analytical effort. The focus will be the application to Monte Carlo methods – generally the most challenging from the computational point of view. With several examples I will illustrate the workings of AAD and demonstrate how it can be straightforwardly implemented to reduce the computation time of the risk of any portfolio by order of magnitudes.

Download flyer here and slides here.

All interested people are kindly invited.

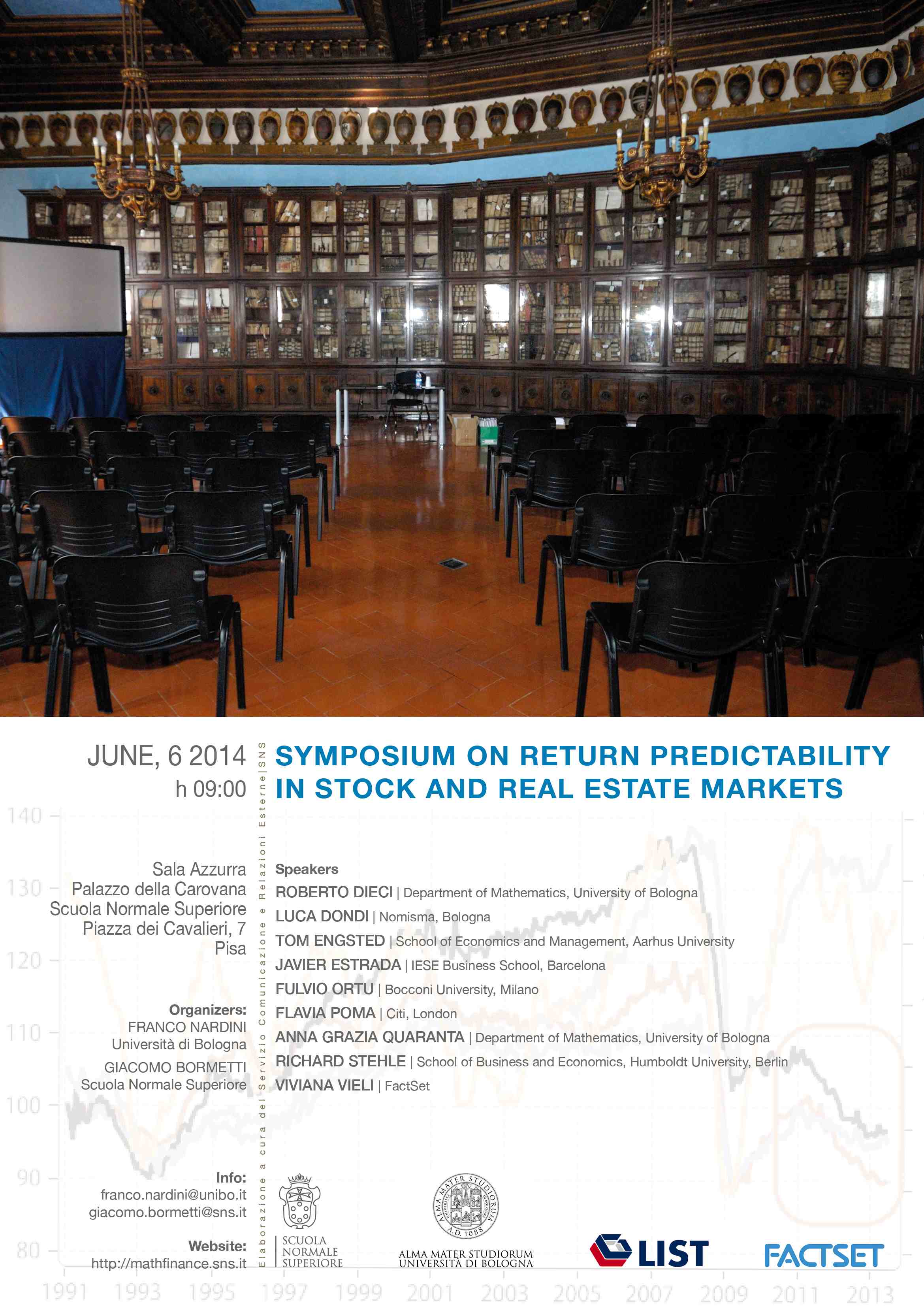

Symposium on return predictability in stock and real estate markets

Paolo Porcedda, “Asimmetrie informative e selezione avversa nella gestione del portafoglio creditizio nell’esperienza di un primario istituto creditizio italiano”

Monday April 7 2014

13.00

Scuola Normale Superiore

Aula Bianchi

Paolo Porcedda

UniCredit Bank

Abstract

Alimentata dalle pressioni esercitate dalle autorità di vigilanza bancaria a seguito dell’introduzione della nuova normativa regolamentare (cd Basilea 2), nei primi anni 2000 i principali istituti di credito delle economie avanzate cercarono di dotarsi di sistemi centralizzati di misurazione della probabilità di default delle controparti affidate fondati su modelli statistici, in alcuni casi anche molto complessi. Il salto “culturale” comportato da tale riassetto organizzativo, con le implicazioni che ne sono derivate in termini di pratiche decisionali e sistemi di misurazione delle performance aziendali e relativa incentivazione, potrebbe essere tra le cause dei problemi di esigibilità dei prestiti riscontrati negli anni più recenti.

Secondo la nostra tesi, infatti, i profondi cambiamenti causati da tali ristrutturazioni nei processi di valutazione ed erogazione del credito non hanno, da un lato, tenuto in piena considerazione gli effetti dell’asimmetria informativa venutasi a creare con il nuovo modello organizzativo (risk management accentrato, che “cala” le proprie valutazioni sulla rete distributiva che eroga i prestiti) e ciò ha portato ad un tipico paradosso di “principal-agent” non facilmente risolvibile con le sole soluzioni già proposte nella

letteratura esistente sull’argomento. Dall’altro, sono stati sottovalutati i problemi di selezione avversa che i modelli quantitativi di misurazione del merito di credito implicano se applicati senza gli adeguati correttivi.

Andrea Pallavicini, “Credit Risk Modelling Before and After the Crisis”

Vittorio Carlini, “Mercati finanziari e l’illusione dei numeri”

Thursday March 13 2014

13:00

Scuola Normale Superiore

Aula Bianchi

Vittorio Carlini

Il Sole24Ore

Abstract

L’hardware delle reti, i modelli matematici e i software dei prodotti dominano le Borse. Una dinamica che dimentica l’economia reale e le aziende.

Emmanuel Bacry, “Hawkes process and applications”

Thursday February 27 2014

13.00

Scuola Normale Superiore

Aula Bianchi

Emmanuel Bacry

CMAP, UMR 7641 CNRS, Ecole Polytechnique, France

Abstract

Hawkes processes are point self-exciting point processes particularly well suited for applications. Introduced in the 70s, that have been used in very various domaines such as high-frequency financial time-series modeling or viral diffusion in social networks.

After describing how they are defined and their main properties, we shall discuss some problems linked to parametric estimations (in high dimensions) as well as non parametric estimations. We will present several applications.

Youngna Choi, “Financial Instability Contagion: a Dynamical Systems Approach”

Thursday January 9 2014

13.00

Scuola Normale Superiore

Aula Bianchi

Youngna Choi

Montclair State University

Abstract

We build a multi-agent dynamical system for the global economy to investigate and analyze financial crises. The agents are large aggregates of a subeconomy, and the global economy is a collection of subeconomies. We use well-known theories of dynamical systems to represent a financial crisis as propagation of a negative shock on wealth due the breakage of a financial equilibrium. We first extend the framework of the market instability indicator, an early warning signal defined for a single economy as the spectral radius of the Jacobian matrix of the wealth dynamical system. Then, we formulate a quantitative definition of instability contagion in terms thereof. Finally, we analyze the mechanism of instability contagion for both single and multiple economies. Our contribution is to provide a methodology to quantify and monitor the level of instability in sectors and stages of a structured global economic model and how it may propagate between its components.

Emilio Barucci, “Does a countercyclical buffer affect bank management?”

Monday October 7 2013

13.00

Scuola Normale Superiore

Aula Bianchi

Emilio Barucci

Politecnico di Milano

Abstract

We analyze the effect of the countercyclical capital buffer, as provided by the Basel III regulation, on bank management.

The goal of the regualtion is to reduce bank leverage and excess risk taking.

We show that the countercyclical buffer increases the incentive for equity holders to take excess risk investing in assets with high drift rate independently of their volatility. Therefore, the buffer induces risk-shifting incentives, however it is effective in reducing the bank size and its leverage but the magnitudo is rather small.

Joint work with Luca Del Viva, ESADE Business School

Ying Chen, “Filtering Asynchronous High Frequency Data”

Tuesday June 4 2013

13.00

Scuola Normale Superiore

Aula Bianchi

Ying Chen

Department of Statistics & Applied Probability – National University of Singapore

Abstract

We develop a synchronizing technique for irregularly spaced and asynchronous high frequency data. The technique learns from the dependence structure of raw data and iteratively recovers the unobserved values of the synchronous series at high sampling frequency.

The numerical results illustrate the performance of the proposed technique and compared to the conventional techniques — Previous Tick technique and Refresh Time technique. The proposed technique provides good performance in terms of accuracy and feature.

Moreover, a realized covariance estimator is constructed by incorporating the synchronized technique. We compare the feature of the estimator with several alternative estimators.

Matthieu Cristelli, “A New Metrics for Country Fitness and Product Complexity”

Wednesday May 22 2013

13.00

Scuola Normale Superiore

Aula Bianchi

Matthieu Cristelli

ISC-CNR, Institute for Complex Systems –

Department of Physics, “Sapienza” University

Abstract

Classical economic theories prescribe specialization of countries industrial production. Inspection of the country databases of exported products shows that this is not the case: successful countries are extremely diversified, in analogy with biosystems evolving in a competitive dynamic environment. The challenge is assessing quantitatively the non-monetary and non-income based competitive advantage of diversification which represents the hidden potential for development and growth. In a series of recent works [1,2] we develop a new statistical approach based on coupled non-linear maps, whose fixed point defines a new metrics for the country Fitness and product Com-plexity. The idea underlying such an approach is that the intangible features determining the competitiveness of a country can be quantified by properly measuring what a country exports. We show that a non-linear iteration is necessary to bound the complexity of products by the fitness of the less competitive countries exporting them. Given the paradigm of economic complexity, the correct and simplest approach to measure the competitiveness of countries is the one presented in this work.The two metrics allow to define a new kind of fundamental analysis of the hidden growth potential of countries. It is possible to compare non-monetary factors of fitness and complexity with measures of economic intensity such as the countries GDP per capita. We argue that this comparison is informative on the growth potential of countries. As an example, countries that show both a high fitness and a high complexity, but a low GDP per capita, are very likely to strongly boost their income in the next years. From preliminary analysis with growth data from 1995 to 2010, it is possible to see that results well reflect what occurred in the real world over that period.

Paolo Guasoni, “Frictions and Fees in Portfolio Choice”

Monday May 13 2013, 16.00 – 18.00 Aula 2

Tuesday May 14 2013, 11.00 – 13.00 Aula 2

Wednesday May 15 2013, 14.00 – 16.00 Aula Bianchi

Thursday May 16 2013, 11.00 – 13.00 Aula 2

Scuola Normale Superiore

Paolo Guasoni

Boston University and Dublin College University

Frictions and Fees in Portfolio Choice

All interested people are kindly invited.

Jean-Philippe Bouchaud, “Instabilities in Financial Markets”

Thursday May 9 2013, 16.00 – 18.00 Aula Mancini

Friday May 10 2013, 14.00 – 16.00 Aula Mancini

Monday May 13 2013, 9.00 – 11.00 Aula Bianchi

Scuola Normale Superiore

Jean-Philippe Bouchaud

Capital Fund Management and Ecole Polytechnique

Instabilities in Financial Markets

May 9 “Stylized facts: old pieces and new results”

May 10 “Price formation, market impact and HFT”

May 13 “Instabilities: some (dangerous) feedback loops”

All interested people are kindly invited.

Rama Cont, “Functional Ito calculus and Functional Kolmogorov equations”

Monday April 8 2013, 10.00 – 13.00 Aula Tonelli

Monday April 15 2013, 10.00 – 13.00 Aula Tonelli

Monday April 22 2013, 10.00 – 13.00 Aula Tonelli

Tuesday April 23 2013, 9.00 – 12.00 Aula 2

Wednesday April 24 2013, 9.00 – 12.00 Aula Dini

Monday May 27 2013, 10.00 – 13.00 Aula Tonelli

Scuola Normale Superiore

Rama Cont

Imperial College London and CNRS

Laboratoire de Probabilités et Modeles Aléatoires, Université Paris VI-VII

Functional Ito calculus and Functional Kolmogorov equations

All interested people are kindly invited.

Fulvio Corsi, “When Micro Prudence increases Macro Risk: The Destabilizing Effects of Financial Innovation, Leverage, and Diversification”

Wednesday March 6 2013

13:00

Scuola Normale Superiore

Aula Mancini

Fulvio Corsi

Scuola Normale Superiore

Abstract

By exploiting basic common practice accounting and risk management rules, we propose a simple analytical dynamical framework to investigate the effects of micro- prudential changes on macro-prudential outcomes. Specifically, we study the consequence of the introduction of a financial innovation that allow reducing the cost of portfolio diversification in a financial system populated by financial institutions having capital requirements in the form of VaR constraint and following standard mark-to- market and risk management rules. We provide a full analytical quantification of the multivariate feedback effects between investment prices and bank behavior induced by portfolio rebalancing in presence of asset illiquidity and show how changes in the constraints of the bank portfolio optimization endogenously drive the dynamics of the balance sheet aggregate of financial institutions and, thereby, the availability of bank liquidity to the economic system and systemic risk. The model shows that when financial innovation reduces the cost of diversification below a given threshold, the strength (due to higher leverage) and coordination (due to similarity of bank portfolios) of feed- back effects increase, triggering a transition from a stationary dynamics of price returns to a non stationary one characterized by steep growths (bubbles) and plunges (bursts) of market prices.

Federico Poloni and Giacomo Sbrana, “Estimating Econometric Models through Matrix Equations”

Tuesday March 5 2013

13.00

Scuola Normale Superiore

Aula Bianchi

Federico Poloni

Dipartimento di Informatica – Università di Pisa

Giacomo Sbrana

Rouen Business School

Abstract

We present an algorithm to estimate the parameters of multivariate ARMA, GARCH and stochastic volatility models. The approach is based on a moment estimator; a similar approach has already been suggested in literature for univariate GARCH but its generalization to multivariate models requires some more linear algebra machinery, especially in the field of matrix equations.

The resulting estimator is extremely fast to compute, in comparison to maximum-likelihood approaches. We also discuss methods to regularize and improve this estimate.

Marco Bianchetti, “Consistent No-Arbitrage Derivatives’ Pricing Including Funding And Collateral”

Tuesday January 29 2013

13:00

Scuola Normale Superiore

Aula Bianchi

Marco Bianchetti

Intesa Sanpaolo

Abstract

We revisit the problem of general no-arbitrage pricing of derivatives including the funding component. We show that, by adopting the no-arbitrage approach based on replication, PDE, and Feynman-Kac theorem, an appropriate treatment of the self-financing conditions allows straightforward and consistent proofs of the relevant pricing formulas covering a broad range of cases. In particular, we firstly recover the basic results for single currency funding of derivatives including, step by step, perfect or partial collateral, repo, and dividends. Next, we generalize the analysis to the case of multiple currency funding, and we examine the special case of interest rate derivatives. These results are useful to provide a simple and consistent framework of modern pricing formulas, fostering a broader understanding of the current market practice of CSA discounting, and to set solid theoretical grounds supporting further generalizations to include other risk factors, counterparty risk (CVA and DVA) in particular.

Download Flyer

Marko Weber, “Dynamic Trading Volume”

Tuesday November 6 2012

13:00

Scuola Normale Superiore

Aula Bianchi

Marko Weber

Dublin City University and Scuola Normale Superiore Pisa

Abstract

We derive the process followed by trading volume, in a market with finite depth and constant investment opportunities, where a representative investor, with a long horizon and constant relative risk aversion, trades a safe and a risky asset. Trading volume approximately follows a Gaussian, mean-reverting diffusion, and increases with depth, volatility, and risk aversion. The model generates an endogenous ban on leverage and short-selling. Joint work with Paolo Guasoni.

Download Flyer

Bence Toth, “Anomalous Price Impact and the Critical Nature of Liquidity in Financial Markets”

Tuesday July 24 2012

12:00

Scuola Normale Superiore

Aula Bianchi

Bence Toth

Capital Fund Management, Paris, France

Abstract

We propose a dynamical theory of market liquidity that predicts that the average supply/demand profile is V-shaped and vanishes around the current price. This result is generic, and only relies on mild assumptions about the order flow and on the fact that prices are (to a first approximation) diffusive. This naturally accounts for two striking stylized facts: first, large metaorders have to be fragmented in order to be digested by the liquidity funnel, leading to long-memory in the sign of the order flow. Second, the anomalously small local liquidity induces a breakdown of linear response and a diverging impact of small orders, explaining the “square-root” impact law, for which we provide additional empirical support. Finally, we test our arguments quantitatively using a numerical model of order flow based on the same minimal ingredients.

James G. M. Gatheral, “Arbitrage-free SVI volatility surfaces”

Wednesday July 18 2012

13:00

Scuola Normale Superiore

Aula 2

James G. M. Gatheral

Baruch College, The City University of New York

Abstract

In this talk we motivate the widely-used SVI (“stochastic volatility inspired”) parameterization of the implied volatility surface and show how to calibrate it in such a way as to guarantee the absence of static arbitrage. In particular, we exhibit a large class of arbitrage-free SVI volatility surfaces with a simple closed-form representation. We demonstrate the high quality of typical SVI fits with a numerical example using recent SPX options data. We conclude by suggesting that SVI might one day replace SABR as the implied volatility parameterization of choice.

Download Slides

James G. M. Gatheral, “Optimal Order Execution”

Friday July 13 2012

11:30

Scuola Normale Superiore

Aula Bianchi

James G. M. Gatheral

Baruch College, The City University of New York

Abstract

We review various models of market impact. We use variational calculus to derive optimal execution strategies, noting that in many conventional models, static strategies are dynamically optimal. We then present a model in which the optimal strategy does depend on the stock price and derive an explicit closed-form solution for this strategy by solving the HJB equation. We discuss price manipulation, indicating modeling choices for which this is unlikely to be a problem. We present empirical evidence and some heuristic arguments justifying the well-known square-root formula for market impact. Assuming price dynamics that are consistent with the square-root formula, we suggest likely properties of optimal execution strategies.

Download Slides

Enrico Scalas, “Intraday Option Pricing”

Tuesday June 19 2012

11:00

Scuola Normale Superiore

Aula Bianchi

Enrico Scalas

DISIT, Università del Piemonte Orientale and Basque Center for Applied Mathematics, Bilbao

Abstract

A stochastic model for pure-jump diffusion (the compound renewal process) can be used as a zero-order approximation and as a phenomenological description of tick-by-tick price fluctuations. This leads to an exact and explicit general formula for the martingale price of a European call option. A complete derivation of this result is presented by means of elementary probabilistic tools.

Reference: Scalas E. and Politi M. (2012). A parsimonious model for intraday European option pricing. Economics Discussion Papers, No 2012-14, Kiel Institute for the World Economy.

Cecilia Mancini, “Spot Volatility Estimation Using Delta Sequences”

Monday May 7 2012

13:00

Scuola Normale Superiore

Aula Bianchi

Cecilia Mancini

Università di Firenze

Abstract

Work done in collaboration with V.Mattiussi and R.Renò.

Download Flyer

Robert Almgren, “Quantitative Problems in Optimal Execution”

Friday April 13 2012

13:00

Scuola Normale Superiore

Aula Bianchi

Robert Almgren

New York University and Quantitative Brokers

Abstract

Execution of large transactions so as to minimize market impact and trading costs is a very important aspect of modern financial markets. We will give an overview of the quantitative tools that are used to approach this problem and how they are implemented in practice. These include balance of risk and reward, design of optimal trajectories, and the mathematical issues that arise in optimal response to time-varying liquidity and volatility.

Maria Elvira Mancino, “Fourier Volatility Estimation Method: Theory and Applications with High Frequency Data”

Wednesday March 14 2012

13.00 – 14.00

Scuola Normale Superiore

Aula Bianchi

Maria Elvira Mancino

Università di Firenze

Download Flyer Download Slides

Roberto Renò, “Price and Volatility Co-Jumps”

Wednesday February 15 2012

13:00

Scuola Normale Superiore

Aula Bianchi

Roberto Renò

Università degli Studi di Siena

Abstract

A sizeable proportion of large, discontinuous, changes in asset prices are found to be associated with contemporaneous large, discontinuous, changes in volatility (i.e., co-jumps), negative price jumps usually occurring along with positive volatility jumps. We document that the co-jumps yield an economically-meaningful portion of leverage, return skewness, and the implied volatility smirk. These, and other, effects are uncovered in the context of a flexible modeling approach (allowing, among other features, for independent as well as common jumps, volatility-dependent jump arrivals, and time-varying leverage) and a novel identification strategy relying on infinitesimal cross-moments and high-frequency price data.

Download Flyer Download Slides

Emmanuel Bacry, “Modelling Microstructure using Multivariate Hawkes Processes”

Wednesday December 14 2011

13:00

Scuola Normale Superiore

Aula Bianchi

Emmanuel Bacry

Ecole Polytechnique

Abstract

Hawkes processes are used for modelling tick-by-tick variations of a single or of a pair of asset prices. For each asset, two counting processes (with stochastic intensities) are associated respectively to the positive and negative jumps of the price. We show that, by coupling these intensities using a kernel function, one can reproduce high-frequency mean reversion structure as well as Epps effect which are both characteristic of the microstructure. We define a numerical method that provides a non-parametric estimation of the kernel shape, it is find to be slowly decaying (power-law) suggesting a long memory nature of self-excitation phenomena at the microstructure level of price dynamics. The consequences for market impact are discussed using a model very simple model for exogeneous trades.

Download Flyer

Domenico Mignacca, “Risk Attribution, Risk Budgeting and Portfolio’s Implied Views: A Factor Approach”

Quantitative Approaches to Risk Assessment and Investment Transparency

Monday December 12 2011

10.45 – 17.00

Sala Stemmi

Scuola Normale Superiore – Pisa

10:45 Registration

11:00 Opening address

Book Presentation: A Quantitative Framework to Assess the Risk- Reward Profile of Non-Equity Products

11:10 Keynote Address – Hélyette Geman

11:50 Special Address – Marcello Minenna, Giovanna Maria Boi, Paolo Verzella

13:00 Lunch

Technical Contributions

14:00 Rita D’Ecclesia

Risk Assessment of debt liabilities: overview and case studies

14:30 Dongning Qu

Understanding Risks in Structured Products

15:00 Paolo Sironi

Enhancing competitiveness through transparent investment decision-making

15:30 Coffee break

Round Table: Risk Transparency through Quantitative Methods

16:00 Moderator – Stefano Marmi

Panelists – Rita D’Ecclesia, Hélyette Geman, Domenico Mignacca, Marcello Minenna, Dongning Qu, Paolo Sironi

For more information please contact: +39 050 509111, s.marmi@sns.it, or fabrizio.lillo@sns.it.

Download event flyer here, and brochure here.

Umberto Cherubini, “CDS and the City”

Wednesday November 23 2011

13:00

Scuola Normale Superiore

Aula Bianchi

Umberto Cherubini

Università di Bologna

Abstract

We discuss the peculiarity of the CDS tool in the realm of credit derivatives. We show how to use such products for the hedging of credit risk and for synthetic creation of it. We show how to use CDS quotes to bootstrap the term structure of the implied probability of default of an obligor. We finally discuss the relevance of the market in which CDS are traded, which is Over-The-Counter. As an illustration we provide a case of CDS used in the funding of a municipal entity.

Rama Cont, “Systemic risk: a challenge for modelling”

Wednesday November 9 2011

15:00

Scuola Normale Superiore

Sala degli Stemmi

Rama Cont

Univ. Paris VI-VII, France and Columbia Univ. New York, USA

Rosario Nunzio Mantegna, “Econophysics Investigation of Financial Markets: Correlation, Heterogeneity and Agent Based Models”

Tuesday October 4 2011 15.00 – 17.00 Aula Bianchi

Wednesday October 5 2011 11.00 – 13.00 Aula Bianchi

Thursday October 6 2011 11.00 – 13.00 Aula Mancini

Scuola Normale Superiore

Rosario Nunzio Mantegna

Università di Palermo

Lecture 1. Correlation, hierarchical clustering and correlation based networks in financial markets

Download slides here.

Lecture 2. Heterogeneity and specialization of investors in financial markets

Download slides here.

Lecture 3. Agent based modeling of financial markets

Download slides here.

Aldo Nassigh, “Default and Credit Migration Risk in Trading Portfolios”

Tuesday September 20 2011

16:00

Scuola Normale Superiore

Aula Bianchi

Monica Billio

Unicredit, Milano

Abstract

Default and credit migration risk was treated as negligible for a long time in banks’ trading portfolios, characterized by an investment horizon of few days. This was consistent with the ‘Constant Level of Risk’ assumption according to which, in case of deterioration of the creditworthiness of the obligor, exposures with high credit quality would have been replaced with the goal of moving the asset allocation back to the original risk profile. If perfect market liquidity and continuous Brownian motion for asset prices are granted, losses induced by the frequent rebalancing of the portfolio can indeed be neglected. The rise and blow up of the Credit Trading bubble (also named Sub-Prime, Lehman and Sovereign crises) showed the shortcomings of such approach. In 2004, the Basel Committee on Banking Supervision asked banks to set aside capital for credit risk in trading portfolios, in response to the rising credit exposures and the improvements in risk management best practice observed in the banking system. Such capital add-on (named ‘Incremental Risk Charge’) will enter into force in December 2011. The proper evaluation of default and credit migration risk under the constant level of risk assumption translates into the call for modeling portfolio credit risk in the framework of short-term, multi-step simulations. Aim of the seminar is to give an update on recent developments regarding modeling the Incremental Risk Charge and to raise some critical and unresolved issues as: the difficulty in adapting to this problem the mainstream treatment of portfolio credit risk by continuous-time Markov Chains applied to the rating migration process; the lack of an unambiguous approach to the estimation of asset correlations, leading to large discrepancies in the capital level required by the various models developed so far.

L’instabilità dei mercati finanziari: il flash crash un anno dopo.

Wednesday May 11 2011

13:00

Scuola Normale Superiore

Aula Bianchi

Stefano Marmi

Scuola Normale Superiore, Pisa

6 maggio 2010: l’effetto farfalla si abbatte sul ping pong del trading ad alta frequenza

Fulvio Corsi

Università della Svizzera Italiana, Lugano

Ordini tossici e crisi di liquidità: un punto di vista accademico sul Flash Crash

Fabrizio Lillo

Scuola Normale Superiore, Pisa, Università di Palermo e Santa Fe Institute, Santa Fe

Trading ad alta frequenza ed instabilità di sistema: il data mining aiuta a comprendere il Flash Crash

Giacomo Bormetti

Scuola Normale Superiore, Pisa e INFN, Pavia

Modelli quantitativi del panico di mercato

Abstract

Durante l’incontro verrà presentata una cronaca degli eventi accaduti il 6 maggio 2010 sul mercato azionario americano ed una rassegna della letteratura apparsa nella stampa specializzata nei mesi successivi.

Download Flyer

Le presentazioni possono essere scaricate seguendo i seguenti links: Slides_Marmi, Slides_Corsi, Slides_Lillo e Slides_Bormetti.

Daniel Nehren and Lorenzo Balducci, “Un incontro con JP Morgan”

Tuesday May 10 2011

15:00

Scuola Normale Superiore

Aula Mancini

Daniel Nehren

Head of Linear Quantitative Research, JP Morgan New York

Introduction to Algorithmic Trading

Lorenzo Balducci

Quantitative Research, JP Morgan London

Quantitative Research at JP Morgan

Following this link you can download the slides of the talk by Lorenzo Balducci: Slides_Balducci.

Franco Nardini, “Innovation, specialization and growth in a model of structural change”

Tuesday April. 19 2011

13:00

Scuola Normale Superiore

Aula Bianchi

Franco Nardini

Università di Bologna

Abstract

The aim of this talk is to investigate the nexus between demand patterns and innovation as it stems from research efforts and the extent of specialization. In the proposed model an innovation race conducted by entrants investing in research and development against established incumbents raises productivity at the industry level and leads to a shift in the aggregate demand pattern and consequently to a redistribution of the profit fund among industries and a restructuring of the production process in each industry. The talk argues that the degree of development as reflected in a demand share distribution is characterized by a corresponding distribution of specialized sectors that becomes more even across industries as the development process proceeds and investigates the consequences in terms of economic growth.

Download Flyer Download Slides

Jean-Philippe Bouchaud, “An introduction to Statistical Phy-nance”

Wednesday April 13 2011, 14.00 – 16.00 Aula Dini

Thursday April 14 2011, 14.00 – 16.00 Aula Dini

Friday April 15 2011, 11.00 – 13.00 Aula Fermi

Scuola Normale Superiore

Jean-Philippe Bouchaud

Science & Finance, Capital Fund Management, Paris

Lecture 1. (Wednesday April 13) The dynamics of price in financial markets

- Fat tails and intermittent dynamics: empirical facts and models

- High frequency and seasonality effects

- Cross sectional and multivariate effects

- Correlations and copulas

Lecture 2. (Thursday April 14) Price formation and microstructure